Automated

investing.

Smart Portfolio is a robo-advisor that gives you a diversified portfolio based on your goals.7 It’s the easy way to invest.

Why automate your investing?

Smart Portfolio7 gives you access to a professionally managed account that’s affordable and easy to use. Just switch it on and let us invest for you regularly.

Designed by experts.

The Empower Investment Team designs and builds each portfolio in order to optimize returns based on a user’s overall risk level.

Fits your budget.

Smart Portfolio is automatically included in a Empower subscription—that means no management or add-on commission fees.

Track your goals.

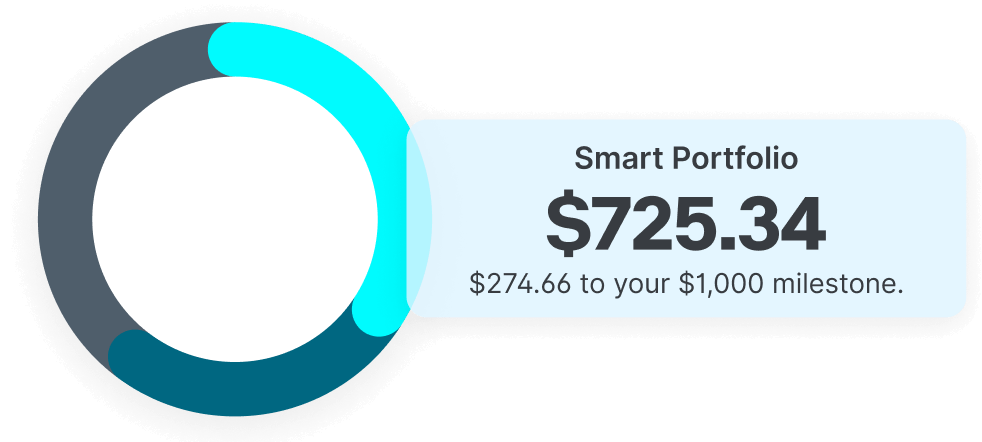

Smart Portfolio automatically monitors and manages your investments—our easy-to-use app gives you 24/7 access to your investment portfolio.

Built for you.

Powered by diversification.

Smart Portfolio builds you a diversified portfolio designed to reduce risk and maximize returns. Unlock broad exposure—according to your risk profile—to US equities, foreign markets, and bonds.

Frequently Asked Questions

What is automated investing?

Automated investing is a tool that automatically builds an investment portfolio for you. This kind of investing passively manages and makes investments on your behalf.

Empowers Smart Portfolio gives you a set of diversified investments that align with your risk profile. It then actively monitors and manages the account for you, automatically rebalancing to keep your investments up to date.

What is a robo-advisor?

A robo-advisor is a digital financial advisor that automatically builds and manages your portfolio based on your investment preferences. These algorithm-driven platforms often rely on passive index investing strategies to reduce buying and selling while investing on your behalf. Robo-advisors are built to consider your risk tolerance and financial goals in order to invest with minimal guidance from a human financial advisor for portfolio management.